U.S. Higher Education Endowments Report 7.7% Return for FY23 While Spending More in Support of Their Missions

2/15/2024

WASHINGTON, DC—Data from the 2023 NACUBO-Commonfund Study of Endowments® (NCSE) show that the endowments of 688 participating U.S. colleges and universities and affiliated foundations returned 7.7 percent, net of fees, for FY23 (July 1, 2022, to June 30, 2023), a sharp reversal of the -8.0 percent return reported for FY22.

In total, participating institutions withdrew $28.4 billion from their endowments during the fiscal year, an 8.4 percent year-over-year increase. According to the report, the largest share of institutions’ spending policy distributions in FY23, 47.7 percent, went to student financial aid; other spending was distributed across academic programs and included research (17.5 percent), endowed faculty positions (11.1 percent), operation and maintenance of campus facilities (7.4 percent), and all other purposes (16.4 percent).

“From the point of view of college and university chief business officers, the results of this year’s endowment study are ideal—a sound rate of return demonstrating good fiscal stewardship leading to additional resources available to the students, faculty, and programs that are our core mission,” said NACUBO President and CEO Kara D. Freeman. “Endowments are complex and managing them in the current financial environment can be difficult, but we see from this fiscal year 2023 data that our students, donors, and institutions are being well served.”

Since NACUBO created the Study of Endowments in 1974, it has become the most comprehensive annual survey and analysis of the endowment management and governance policies and practices of U.S. institutions of higher education and their affiliated foundations. For the 50th Study, NACUBO renewed its partnership with Commonfund to collect, analyze, and publish the data.

Data gathered for the FY23 NCSE show that trailing 10-year returns averaged 7.2 percent, in line with the current year’s 7.7 percent return, albeit moderately lower.

“Longer-term returns are of paramount importance to the financial health and sustainability of perpetual institutions such as colleges and universities,” said George Suttles, Executive Director of the Commonfund Institute. “Endowments generally pursue long-term returns sufficient to fund their annual effective spending rate, keep pace with inflation, pay investment management costs and retain an increment for future endowment growth.”

The 688 institutions in this year’s study represented a total of $839.1 billion in endowment assets. The median endowment size was $209.1 million, and nearly one-third of study participants had endowments that were $100 million or less.

Study data were segmented into seven size cohorts ranging from endowments with assets under $50 million to those with assets over $5 billion. In addition, data were segmented by type of institution: private, public, institutionally related foundations (IRFs), combined endowment/foundations and other.

Asset Allocation

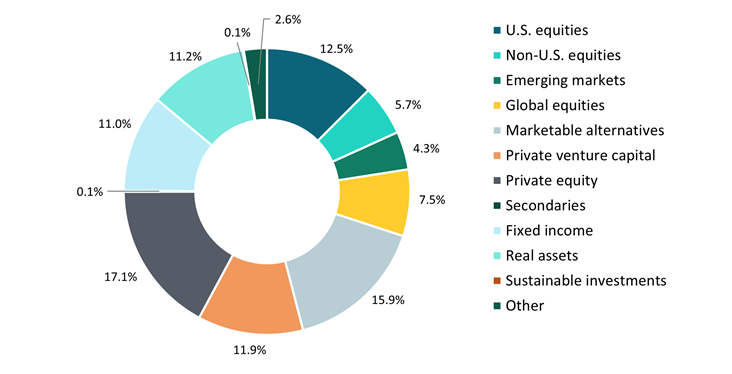

The way participating institutions’ assets were diversified across a range of asset classes and strategies did not reflect material changes from FY22 to FY23 (measured on a dollar-weighted basis). But, as it almost always is, asset allocation was the major factor behind return differences across the seven size cohorts in the study. Historically, institutions with larger endowments often have secured better one-year investment results than those with relatively smaller endowments. The reverse occurred in FY23, owing to smaller institutions’ substantially larger allocations to publicly traded securities—specifically U.S. equities, non-U.S. equities (developed markets), and global equities. These allocations posted the strongest returns for the fiscal year. Larger endowments had smaller allocations to the public equity markets and were more heavily weighted to private investment strategies, where returns generally lagged.

Average Asset Allocation* of Total Study Participants, FY23

Figures in Percent (%)

* Dollar-weighted

For NCSE participants as a whole, alternative investment strategies remained the largest allocation. This included double-digit allocations to private equity (17.1 percent); marketable alternatives (15.9 percent) and venture capital (11.9 percent). Among public equities, the largest allocation was to U.S. equities, at 12.5 percent. Among other double-digit allocations, real assets and fixed income respectively accounted for 11.2 percent and 11.0 percent of allocations.

FY23 Return Detail and Longer-Term Returns

Institutions with assets over $5 billion posted an average return of 2.8 percent for FY23 while those with assets under $50 million realized an average return of 9.8 percent, the highest among the seven size cohorts. Institutions in the three smallest size cohorts were the only ones with average returns of 8.0 percent or more, while institutions with assets above $5 billion trailed all other size cohorts by 310 to 700 basis points.

While the returns of institutions with larger allocations to alternative strategies lagged in FY23, over the longer term they have generally generated higher returns. Institutions with assets over $5 billion reported 10-year average annual returns of 9.1 percent, compared with 7.2 percent among all study participants. Institutions in the other six size categories reported 10-year returns averaging 6.5 percent to 8 percent, with returns generally correlating with endowment size.

Spending Rates and Gifts

Endowments funded an average of 10.9 percent of NCSE participants’ annual operating budgets in FY23. Institutions in the two largest size cohorts—over $5 billion and $1 billion to $5 billion—respectively relied on endowment to fund 17.7 percent and 17.1 percent of their annual operating budgets. Institutions in the other size categories relied on endowment to fund 7.2 percent to 13.4 percent of their budgets.

The average annual effective spending rate in FY23 was 4.7 percent, up from 4.0 percent the previous year. Institutions in the three smaller endowment size cohorts reported effective spending rates of 4.8 percent or 4.9 percent, while institutions in the remaining five size categories reported spending rates of 4.4 percent or 4.5 percent. By type, private institutions reported an effective spending rate of 5.0 percent compared with 4.1 percent for public institutions. The effecting spending rate for institutionally related foundations was 4.2 percent, and for combination endowment/foundations the rate was 3.8 percent.

FY23 new gifts to endowments totaled $13.3 billion among all study participants, down from $14.9 billion in FY22. The average new gift in FY23 for all 688 Study participants was $20.4 million, while the median new gift was $4.7 million.

Responsible Investing

Among the 187 NCSE respondents that reported implementing a responsible investing strategy, 26.7 percent have adopted an Environmental, Social, and Governance (ESG) strategy, 13.7 percent employ negative screening, and 8.1 percent reported using impact investing.[1] Across the size cohorts, ESG was the most widely practiced approach, with 20 to 45 percent of most size cohorts using it. Institutions have adopted ESG at the fastest pace in recent years, surpassing negative screening, which had been used most often in decades past.

Reflections on 50 Years of the Study

To mark the 50th anniversary of the 2023 NACUBO-Commonfund Study of Endowments, NACUBO and Commonfund have also published a complementary white paper to accompany the release of the 2023 report. The white paper reviews key developments in the evolution of endowment management since 1974 beyond annual findings in areas central to endowment management and institutional governance, including long-term trends that have helped to shape thinking and practice in institutional investment management. (Click on this link to access the white paper.)

“The 50th anniversary of the Study of Endowments is an important milestone, especially as you consider how endowments have fueled the growth of higher education over the past half-century, and how their management has adapted to help institutions better leverage their ability to support students, faculty and research, and the many other positive contributions to their local communities and society at large,” NACUBO’s Freeman said.

About NACUBO

NACUBO, founded in 1962, is a nonprofit professional organization representing chief administrative and financial officers at more than 1,700 colleges and universities across the country. NACUBO works to advance the economic vitality, business practices, and support of higher education institutions in pursuit of their missions. For more information, visit www.nacubo.org.

About Commonfund Institute

Commonfund Institute is among the nation’s most trusted sources for relevant, useful, and proprietary data, analytics, and best practices in financial management. The Institute provides a wide variety of resources, including conferences, seminars, roundtables, and online learning through Commonfund Institute Online. Insights cover topics such as endowments and governance; proprietary and third-party research such as the Commonfund Benchmark Studies®; publications including the Commonfund Higher Education Price Index® (HEPI); and events such as the annual Commonfund Forum and Investment Stewardship Academy. For more information, visit www.commonfund.org.

###

[1] ESG is alignment with environmental/social/governance criteria; negative screening (also known as SRI, or socially responsible investing) is barring investments in companies engaged in industries or practices not consistent with ethical guidelines; and impact investing is investments that align with an institution’s mission.

Media Contacts

Katy McCreary

National Association of

College and University

Business Officers

(202) 861-2503

Archana Kannan

Prosek Partners

(215) 962-4650