In the last 19 years, only 1.75 % trading sessions saw intraday gains higher than 5 % .

Mahindra & Mahindra Share Price

M&M share price insights

Company delivered ROE of 17.02% in year ending 31 Mar, 2024 outperforming its 5 year avg. of 11.97%. (Source: Consolidated Financials)

Company has spent 5.38% of its operating revenues towards interest expenses and 7.64% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

10 day moving crossover appeared yesterday. Average price gain of 3.49% within 7 days of this signal in last 5 years.

Mahindra & Mahindra Ltd. share price moved up by 0.52% from its previous close of Rs 2,493.50. Mahindra & Mahindra Ltd. stock last traded price is 2,506.25

Share Price Value Today/Current/Last 2,506.25 Previous Day 2,493.50

Key Metrics

PE Ratio (x) | 27.52 | ||||||||||

EPS - TTM (₹) | 90.62 | ||||||||||

MCap (₹ Cr.) | 3,10,073 | ||||||||||

Sectoral MCap Rank | 2 | ||||||||||

PB Ratio (x) | 4.00 | ||||||||||

Div Yield (%) | 0.85 | ||||||||||

Face Value (₹) | 5.00 | ||||||||||

Beta Beta

| 2.27 | ||||||||||

VWAP (₹) | 2,520.23 | ||||||||||

52W H/L (₹) |

M&M Share Price Returns

| 1 Day | 0.52% |

| 1 Week | -2.85% |

| 1 Month | 16.23% |

| 3 Months | 29.7% |

| 1 Year | 90.01% |

| 3 Years | 210.2% |

| 5 Years | 287.33% |

M&M News & Analysis

News M&M shares surge 3% as BofA upgrades it to Buy, sees 22% upside

M&M shares surge 3% as BofA upgrades it to Buy, sees 22% upside

News Hot Stocks: Brokerage view on HDFC Bank, Apollo Hospitals & Zomato; BofA upgraded M&M

Hot Stocks: Brokerage view on HDFC Bank, Apollo Hospitals & Zomato; BofA upgraded M&M

News Sensex falls 600 pts amid weak global market mood ahead of US inflation data; Nifty below 22,750

Sensex falls 600 pts amid weak global market mood ahead of US inflation data; Nifty below 22,750Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

Announcements

M&M Share Recommendations

Recent Recos

Current

Mean Recos by 35 Analysts

SellSellHoldBuyStrong

Buy

- Target₹2720

- OrganizationMotilal Oswal Financial Services

- BUY

Analyst Trends

| Ratings | Current | 1 Week Ago | 1 Month Ago | 3 Months Ago |

|---|---|---|---|---|

| Strong Buy | 14 | 13 | 14 | 15 |

| Buy | 18 | 18 | 18 | 18 |

| Hold | 2 | 3 | 3 | 3 |

| Sell | - | - | - | - |

| Strong Sell | 1 | 1 | - | - |

| # Analysts | 35 | 35 | 35 | 36 |

M&M Financials

Income (P&L)

Balance Sheet

Cash Flow

Ratios

MD&A

Insights

Employee & Interest Expense

Company has spent 5.38% of its operating revenues towards interest expenses and 7.64% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

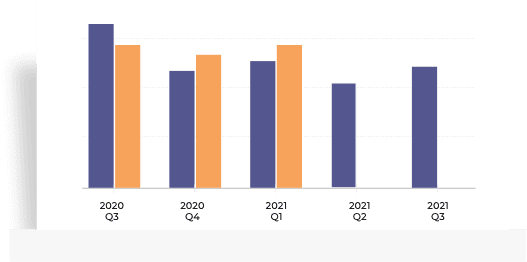

Quarterly | Annual Mar 2024 Dec 2023 Sep 2023 Jun 2023 Mar 2023 Total Income 35,807.44 35,809.91 35,027.23 34,698.68 32,849.56 Total Income Growth (%) -0.01 2.23 0.95 5.63 6.24 Total Expenses 30,182.87 30,198.00 29,844.58 28,773.24 27,960.67 Total Expenses Growth (%) -0.05 1.18 3.72 2.91 7.61 EBIT 5,624.57 5,611.91 5,182.65 5,925.44 4,888.89 EBIT Growth (%) 0.23 8.28 -12.54 21.20 -0.96 Profit after Tax (PAT) 2,754.08 2,658.40 2,347.75 3,508.41 2,636.67 PAT Growth (%) 3.60 13.23 -33.08 33.06 -1.49 EBIT Margin (%) 15.71 15.67 14.80 17.08 14.88 Net Profit Margin (%) 7.69 7.42 6.70 10.11 8.03 Basic EPS (₹) 24.71 23.86 21.07 31.50 23.68 All figures in Rs Cr, unless mentioned otherwise

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Total Assets 2,36,300.73 2,05,891.77 1,74,112.80 1,66,462.49 1,67,006.66 Total Assets Growth (%) 14.77 18.25 4.60 -0.33 2.21 Total Liabilities 1,58,791.39 1,38,809.66 1,17,287.54 1,15,810.26 1,19,345.61 Total Liabilities Growth (%) 14.40 18.35 1.28 -2.96 3.74 Total Equity 77,509.34 67,082.11 56,825.26 50,652.23 47,661.05 Total Equity Growth (%) 15.54 18.05 12.19 6.28 -1.41 Current Ratio (x) 1.30 1.29 1.34 1.40 1.19 Total Debt to Equity (x) 1.56 1.57 1.58 1.43 1.56 Contingent Liabilities 0.00 10,610.92 7,015.76 8,934.97 9,130.31 All figures in Rs Cr, unless mentioned otherwise

Insights

Decrease in Cash from Investing

Company has used Rs 5602.74 cr for investing activities which is an YoY decrease of 34.45%. (Source: Consolidated Financials)

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Net Cash flow from Operating Activities -5,629.95 -7,074.02 9,247.55 17,908.83 -1,456.93 Net Cash used in Investing Activities -5,602.74 -8,547.26 -3,225.82 -18,446.76 -6,894.83 Net Cash flow from Financing Activities 12,281.41 15,946.11 -5,882.60 406.23 6,932.75 Net Cash Flow 1,036.69 5.82 113.00 -117.65 -1,393.97 Closing Cash & Cash Equivalent 4,530.10 3,493.41 3,487.59 3,374.59 4,745.03 Closing Cash & Cash Equivalent Growth (%) 29.68 0.17 3.35 -28.88 -22.71 Total Debt/ CFO (x) -18.33 -12.55 8.07 3.33 -42.91 All figures in Rs Cr, unless mentioned otherwise

Insights

ROE Outperforming 5 Year Average

Company delivered ROE of 17.02% in year ending 31 Mar, 2024 outperforming its 5 year avg. of 11.97%. (Source: Consolidated Financials)

Annual FY 2024 FY 2023 FY 2022 FY 2021 FY 2020 Return on Equity (%) 17.02 18.24 13.95 4.35 0.31 Return on Capital Employed (%) 13.89 12.66 10.27 9.85 9.60 Return on Assets (%) 4.76 4.99 3.77 1.08 0.07 Interest Coverage Ratio (x) 3.61 3.69 3.11 1.86 1.80 Asset Turnover Ratio (x) 0.63 0.68 0.49 44.62 45.13 Price to Earnings (x) 19.01 12.56 13.64 48.78 250.00 Price to Book (x) 3.24 2.29 1.90 2.12 0.79 EV/EBITDA (x) 11.70 10.11 10.43 9.79 6.60 EBITDA Margin (%) 19.46 17.72 17.31 19.80 18.86 MANAGEMENT DISCUSSION AND ANALYSIS (FY 20-21)

Tractors beat covid

F21 was an unusual year for the Indian tractor industry - though the pandemic resulted in demand slowdown in many industries, the demand in the tractor industry was growing rapidly and industry players were finding it difficult to full the demand due to supply constraints. In F21, the Indian tractor market (the world's largest by (volume), witnessed a growth of 27% over F20 and reached a peak level of 899,407. The rainfall during FY21 was 9% higher than Long Period Average (LPA) rainfall, with good temporal and spatial distribution. It is worth noting that in F21 we have had the 3rd highest cumulative rainfall in 25 years. It was also the first time since 1960 that India had two back-to-back above average monsoons. This also led to increase in reservoir levels. As a result, the country had two years of successive bumper crops, both during Rabi and Kharif season.

Commodity Prices - Potential trouble maker

A surge in post-pandemic global demand coupled with severe supply side constraints resulted a sharp rise in commodity prices. This impacted the cost of various inputs used by the industry, including castings, forgings, steel sheets and precious metals. While there was a significant impact of the same on material cost, your Company was able to limit the impact through concerted efforts towards cost reduction with various initiatives including VAVE activities. For F22, while your Company will take all steps to mitigate risks from the COVID-19 crisis, the increase in prices of certain commodities is likely to have an adverse impact on material cost in the first half of the financial year. However, the Company does expect prices of commodities to soften in the second half of the year with supply side constraints easing, limiting the impact. Your company will continue to work on mitigating the inflationary impacts through cost re-engineering and value engineering activities.

Assets and Debt

As at 31 March, 2021, the Property, Plant and Equipment and Intangible Assets stood at Rs. 15,012 crores as compared to Rs. 14,404 crores as at 31 March, 2020. During the year, the Company incurred capital expenditure of Rs. 2,839 crores (previous year Rs. 3,992 crores). The major items of capital expenditure were on new product development and capacity enhancement. Borrowings (including current maturities of long-term debt and unclaimed matured deposits) have increased from Rs. 3,068 crores in the previous year to Rs. 7,667 crores in the current year, mainly due to new borrowings in current year.

Peer Comparison

M&M Stock Performance

Ratio Performance

Insights

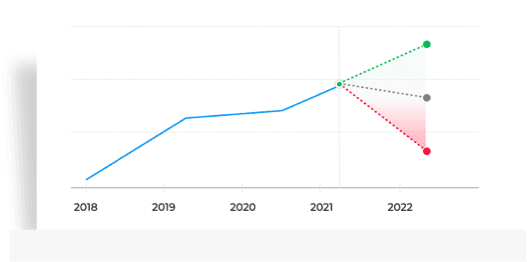

Stock Returns vs Nifty 100

Stock gave a 3 year return of 210.83% as compared to Nifty 100 which gave a return of 48.95%. (as of last trading session)Stock Returns vs Nifty Auto

Stock generated 210.83% return as compared to Nifty Auto which gave investors 123.94% return over 3 year time period. (as of last trading session)

Choose from Peers

Choose from Stocks

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 5Y

Loading...Insights

Stock Returns vs Nifty 100

Stock gave a 3 year return of 210.83% as compared to Nifty 100 which gave a return of 48.95%. (as of last trading session)Stock Returns vs Nifty Auto

Stock generated 210.83% return as compared to Nifty Auto which gave investors 123.94% return over 3 year time period. (as of last trading session)

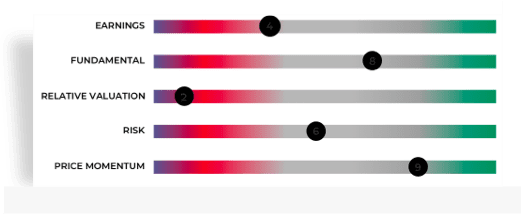

See All Parameters

MF Ownership

1,031.72

Amount Invested (in Cr.)

3.09%

% of AUM

10.78

% Change (MoM basis)

970.36

Amount Invested (in Cr.)

2.14%

% of AUM

0.00

% Change (MoM basis)

874.13

Amount Invested (in Cr.)

2.45%

% of AUM

0.00

% Change (MoM basis)

MF Ownership as on 30 April 2024

M&M F&O Quote

Futures

Options

- Expiry

Price

2,527.1515.00 (0.60%)

Open Interest

56,3506,300 (11.18%)

Open High Low Prev Close Contracts Traded Turnover (₹ Lakhs) 2,541.00 2,588.80 2,516.65 2,512.15 21,268 1,89,668.58 Open Interest as of 24 Apr 2024

Corporate Actions

M&M Board Meeting/AGM

M&M Dividends

- Others

Meeting Date Announced on Purpose Details May 16, 2024 May 06, 2024 Board Meeting Audited Results, Final Dividend & A.G.M. Feb 14, 2024 Feb 01, 2024 Board Meeting Quarterly Results Nov 10, 2023 Oct 23, 2023 Board Meeting Quarterly Results Aug 04, 2023 Jul 26, 2023 Board Meeting Quarterly Results Aug 04, 2023 May 26, 2023 AGM A.G.M. & Rs.16.2500 per share(325%)Dividend Type Dividend Dividend per Share Ex-Dividend Date Announced on Final 325% 16.25 Jul 14, 2023 May 26, 2023 Final 231% 11.55 Jul 14, 2022 May 30, 2022 Final 175% 8.75 Jul 15, 2021 May 28, 2021 Final 47% 2.35 Jul 16, 2020 Jun 12, 2020 Final 422% 21.1 - May 16, 2024 All Types Ex-Date Record Date Announced on Details Bonus Dec 21, 2017 Dec 23, 2017 Nov 10, 2017 Bonus Ratio: 1 share(s) for every 1 shares held Splits Mar 29, 2010 Mar 30, 2010 Jan 25, 2010 Split: Old FV10.0| New FV:5.0 Bonus Sep 01, 2005 Sep 02, 2005 Jun 14, 2005 Bonus Ratio: 1 share(s) for every 1 shares held Bonus Dec 20, 1995 Jan 23, 1996 Dec 07, 1996 Bonus Ratio: 2 share(s) for every 3 shares held Bonus Dec 20, 1995 Jan 23, 1996 Nov 07, 1995 Bonus Ratio: 2 share(s) for every 3 shares held

About M&M

Mahindra & Mahindra Ltd., incorporated in the year 1945, is a Large Cap company (having a market cap of Rs 310,073.91 Crore) operating in Auto sector. Mahindra & Mahindra Ltd. key Products/Revenue Segments include Automobile-Light, Medium & Heavy Commercial, Jeep, Passenger Car, Other Operating Revenue, Sale of services for the year ending 31-Mar-2023. Show More

Executives

Auditors

- AG

Anand G Mahindra

ChairmanASAnish Shah

Managing Director & CEORJRajesh Jejurikar

Executive Director & CEOCPC P Gurnani

Non Exe.Non Ind.DirectorVKVijay Kumar Sharma

Nominee DirectorHKHaigreve Khaitan

Independent DirectorShow More - B S R & Co. LLP

Industry

Key Indices Listed on

Nifty 50, S&P BSE Sensex, Nifty 100, + 32 more

Address

Gateway Building,Apollo Bunder,Mumbai, Maharashtra - 400001

More Details

Brands

FAQs about M&M share

- 1. What is M&M share price and what are the returns for M&M share?As on 31 May, 2024, 03:59 PM IST M&M share price was up by 0.52% basis the previous closing price of Rs 2,533.65. M&M share price was Rs 2,506.25. Return Performance of M&M Shares:

- 1 Week: M&M share price moved down by 2.85%

- 1 Month: M&M share price moved up by 16.23%

- 3 Month: M&M share price moved up by 29.70%

- 6 Month: M&M share price moved up by 52.10%

- 2. What is 52 week high/low of M&M share price?52 Week high of M&M share is Rs 2,617.40 while 52 week low is Rs 1,303.25

- 3. What is the CAGR of M&M?The CAGR of M&M is 16.98.

- 4. Is M&M giving dividend?Mahindra & Mahindra Ltd. announced an equity dividend of 325% on a face value of 5.0 amounting to Rs 16.25 per share on 26 May 2023. The ex dividend date was 14 Jul 2023.

- 5. Who is the chairman of M&M?Anand G Mahindra is the Chairman of M&M

- 6. What are the returns for M&M share?Return Performance of M&M Shares:

- 1 Week: M&M share price moved down by 2.85%

- 1 Month: M&M share price moved up by 16.23%

- 3 Month: M&M share price moved up by 29.70%

- 6 Month: M&M share price moved up by 52.10%

- 7. Who are peers to compare M&M share price?Top 4 Peers for M&M are Tata Motors Ltd., Maruti Suzuki India Ltd., Ashok Leyland Ltd. and Force Motors Ltd.

- 8. Who's the owner of M&M?

- Promoter holding have gone down from 19.37 (30 Jun 2023) to 18.59 (31 Mar 2024)

- Domestic Institutional Investors holding have gone down from 26.82 (30 Jun 2023) to 26.05 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 40.14 (30 Jun 2023) to 41.75 (31 Mar 2024)

- Other investor holding have gone down from 13.66 (30 Jun 2023) to 13.61 (31 Mar 2024)

- 9. What is the market cap of M&M?Market Capitalization of M&M stock is Rs 3,10,074 Cr.

- 10. What are the M&M quarterly results?Total Revenue and Earning for M&M for the year ending 2024-03-31 was Rs 141254.69 Cr and Rs 11268.64 Cr on Consolidated basis. Last Quarter 2024-03-31, M&M reported an income of Rs 35807.44 Cr and profit of Rs 2754.08 Cr.

- 11. What is the PE & PB ratio of M&M?The PE ratio of M&M stands at 27.52, while the PB ratio is 3.59.

- 12. Who is the CEO of M&M?Anish Shah is the Managing Director & CEO of M&M

- 13. Is M&M a good buy?As per Refinitiv (erstwhile Thomson Reuters), overall mean recommendation by 35 analysts for M&M stock is to Buy. Recommendation breakup is as follows

- 13 analysts are recommending Strong Buy

- 18 analysts are recommending to Buy

- 3 analysts are recommending to Hold

- 1 analyst is recommending Strong Sell

- 14. How can I quickly analyze M&M stock?Key Metrics for M&M are:

- PE Ratio of M&M is 27.52

- Price/Sales ratio of M&M is 1.54

- Price to Book ratio of M&M is 4.00

Trending in Markets

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.