Equity compensation is effective in both public and private corporations, large and small, to boost employee engagement. So, companies like to use different forms of equity to allow their employees to partake in ownership of the firm to achieve enhanced productivity and many other benefits.

Despite offering multiple benefits, equity compensation comes with challenges – one of them is administration. In this article, we’ll discuss:

What does a job in equity plan administration involve?

Equity plan administration, commonly known as share plan or stock plan administration, is the process of creating, tracking and managing employee equity and employee plans in a company. It involves input from internal and external parties.

- Examples of employee equity awards: Approved/Unapproved Options, Executive Stock Options, ISOs, NSOs, Cash-settled SARs, Stock-settled SARs, RSUs, RSAs, Performance stock/units, Phantom shares, Cash-based, warrants and a wide range of other custom award types.

- Examples of employee plan types: Approved and Unapproved purchase plans, ESPPs, LTIPs, JSOPs and a wide range of country-specific and custom types.

Once you have your equity plan (or stock plan/share plan) launched, the administration process kicks off. It’ll involve everything from tracking and reporting changes in ownership to updating documents/policies/procedures, communicating with stakeholders, consulting your board of directors, and staying compliant based on each region your employees are based in.

Not only are Legal, Finance and HR teams required to input in this process, but also multiple third-party providers – law firms for setting it up, brokers for the trading element and tax professionals to tell you what the requirements are from region to region.

So, a stock plan administrator is required to understand the extensive accounting, tax, legal, and securities regulations governing employee equity and other broad-based plans.

Which team is responsible for stock plan administration?

According to a 2020 survey, over 70% of the companies report that the primary responsibility for the administration of their stock plan is housed within their HR or compensation & benefits department. (Source: NASPP and Deloitte 2020 domestic stock plan administration survey)

Let’s break equity compensation administration down

Based on the definition above, equity compensation administration is a complex process. Here, we break it down into eight major components for you and your team to consider:

To learn more about these considerations, head over to our equity compensation management guide.

Our Global Compliance advisory team is made up of in-house lawyers, tax specialists and fully accredited stock plan professionals. Our team has helped clients launch and operate plans in more than 140 countries. Contact us today to learn more about how to manage your administration challenges and reduce risk and engage your employees with equity rewards.

How to administer your equity plan?

Equity plan administration can be performed in-house, outsourced or both by:

- Creating a spreadsheet and setting up formulas from scratch;

- Onboarding an employee share plan provider and using their stock plan services

Pros & cons of using spreadsheets

When you’re starting out, it is possible to build a stock plan from scratch using a spreadsheet and manage the equity on it. We’ve heard some companies do this but it doesn’t scale with their company as their ownership plan grows.

| PROs | CONs |

| Low setup cost | Causes human error easily |

| Easily accessible | Has scalability issues as you grow |

| Allows no/low automation | |

| Lacks control, resulting in many versions | |

| Time-consuming | |

| Requires an extensive understanding of tax/compliance in each jurisdiction |

To read more about the dangers of managing stock plans with spreadsheets, click here.

Pros & cons of using an employee share plan provider

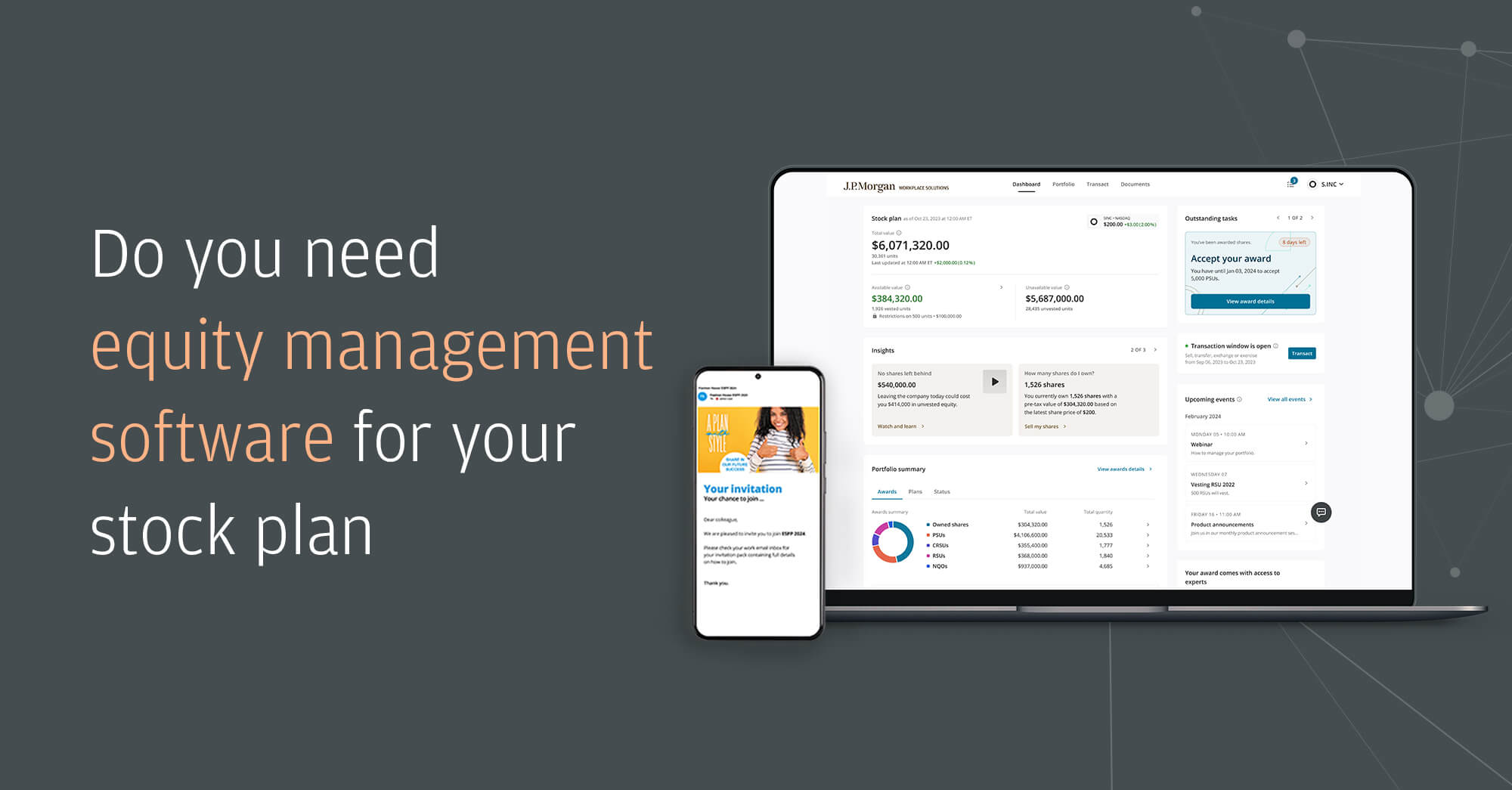

Another way to administer your plan is to leverage an experienced and professional equity plan administration provider.

In large private companies, pre-public companies, and public companies, it’s usual to see this function outsourced. By bringing in a specialized stock plan provider like us, you can focus on your core business while leveraging their experience and knowledge to ensure high-quality equity programs.

Although you may have to pay to use their services, it could end up saving you time (and money) in the long run as their services and product are tailor-made for helping you with plan administration.

| PROs | CONs |

| Always provides one single source of truth | Higher setup cost |

| Allows automation | Takes time to find the right provider |

| Provides a regulated trading platform | |

| Allows participants to access/view/manage their equity | |

| Easily generates different types of BI/financial reports | |

| Offers human support | |

| Helps you stay legally compliant in each jurisdiction | |

| Secures your data | |

| Saves you time and money in the long run | |

| Provides extensive equity knowledge for each jurisdiction |

To learn more about other benefits of equity plan administration software, read here.

Find your ideal equity plan administration provider

Although it’s possible to use a spreadsheet to administer your stock plan when you’re starting out, why not save yourself some time and effort by starting it right?

We have over 15 years’ experience helping companies of all sizes harness the potential of equity to attract, retain and reward key talent. From software and administration to compliance and reporting – we can help your employees take full advantage of employee equity compensation.

Request a free demo to find out more about our award-winning software. Transform your equity compensation administration with our industry-leading technology. Let us show you how with a quick demo of our software.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.